May 15, 2023

May 15, 2023

Should women investors return to the NSE in 2023, with share prices at historical lows?

Grace Musoke* – 38 – whose background is in media and finance- has been investing at the Nairobi Securities Exchange for the past decade. She has a 9 to 5 job, while her husband is a small business owner who sells computer hardware. Alongside their jobs, they invest in a money market fund and they pay for a home loan.

In 2015, Grace started selling off shares, so they could focus on paying off their home loan. “Prices were high then (in 2015), and it was a good time to sell so that we pay off the mortgage as fast as possible,” Grace said.

According to the Central Bank of Kenya, the country’s 12-month inflation dropped to 8.98% in January from 9.06% in December 2022, affected by the higher food costs due to the biting drought and Kenya having to rely on imports to cover the deficit in local maize production; the staple food. Moreover, in the lights of the Russian-Ukraine war, energy costs rose as the price of crude oil shot up to a high of $120 a barrel in mid-2022. However, the fear of a slowdown in the global economy saw the price of oil drop to $70 a barrel. Also, the fears of a global recession saw foreign investors sell the local currency in favor of the United States Dollar has been one of the reasons the Kenyan shilling has traded at an all-time low against the dollar at Ksh136. Therefore, Grace is hesitant about investing in the stock market this year because of the challenges facing the Kenyan economy.

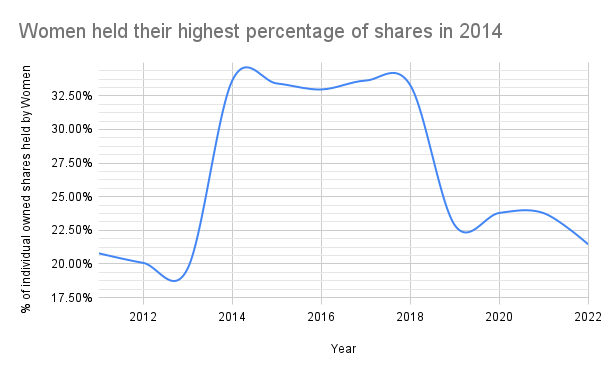

In one of the most obscure yet fascinating statistics, hidden in the Capital Market Authority (CMA) report sent out every quarter, women have held fewer shares at the NSE since 2014. For every 100 shares traded at the Nairobi Securities Exchange at the end of last year (2022), women held 21 shares compare to 34 shares for every 100 in 2014- the highest percentage of shared held by women on the NSE. The data also shows a decline in active CDSC accounts over the same period.

Source: Capital Markets Authority of Kenya Quarterly Statistical Bulletin

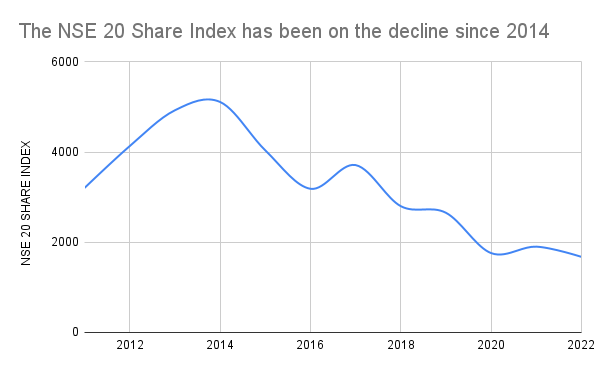

It’s also worth noting that in 2014, the NSE 20 Share Index reached 5,255.62 points in September 2014, the highest over the ten years, 2012 – 2022.

Source Capital Markets Authority Quarterly Statistical Bulletin

Over the last three years, the market capitalization of shares listed on the NSE has reduced by 23.41%, of which 17.64% reduced in 2022. High-interest rates mean that the 60/40 portfolio (60% equities and 40% interest-bearing securities) is back. Lower equity valuations and higher interest rates increase the livelihood of future returns and income streams. Furthermore, the shares of trusted firms whose goods and services are consumed daily are trading at historical lows. In a high interest rate environment, it is good to focus on listed stocks of well-run companies with stable earnings, and dividend payouts. For women investors like Grace, this shapes a great opportunity to return to the market.

*Not her real name.