July 5, 2023

July 5, 2023

Kenya’s Central Bank Rate

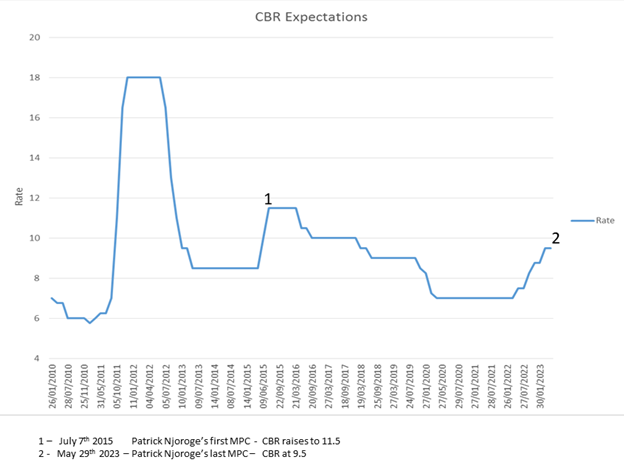

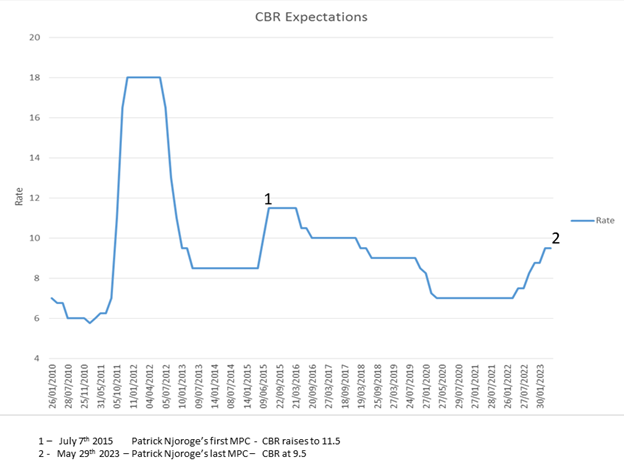

When Dr Patrick Njoroge, the outgoing Central Bank of Kenya Governor, took over in June 2015, his first Monetary Policy Meeting – on July 7, 2015, saw the Central Bank Rate (CBR) rise by 1.5% to 11.5%. It was the largest in his eight years at the helm.

The CBR is the rate at which Kenyan commercial banks borrow from the Central Bank of Kenya. The banks use this rate to set their loans price.

Dr Njoroge’s leadership period oversaw a decline in the cost of borrowing – indicated by the benchmark CBR rate, which steadily dropped to a 10-year low of 7.0 percent in April 2020. However, nearly a year before his exit– specifically starting May 2022 – the cost of borrowing started to rise. He bid farewell to the Central Bank on June 18, 2023, with a CBR of 9.5 percent.

Dr Kamau Thugge, the new Central Bank of Kenya Governor, will be pressured to reduce the CBR. However, it’s a big challenge due to external factors such as the cost of crude oil, the global sugar shortage, and the proposed tax increases that include fuel value-added tax (VAT), which will push up the cost of fuel and food.